There’s no doubt about it. Fintech adoption is booming—global investment activity was valued at $3.2 billion in 1Q2017. Learn how the drive for fintech provides greater flexibility and faster delivery...

Read MoreBig Data

Fintech and the Internet of Things (IoT). These are just two of the countless buzzwords that the IT sector launches at unwary users. But it’s worthwhile learning about them because...

Read MoreFinTech Jolts the Financial Services Market Whether you call fintech changes to the financial services market disruptive, seismic (my favorite) or a technology tsunami, there’s no doubt: technology developments and...

Read MoreWill Google’s TensorFlow Fuel Your Next Breakout Product? In the era of self-driving cars and the Internet of Things (IoT), it can be easy to get caught up in the “window...

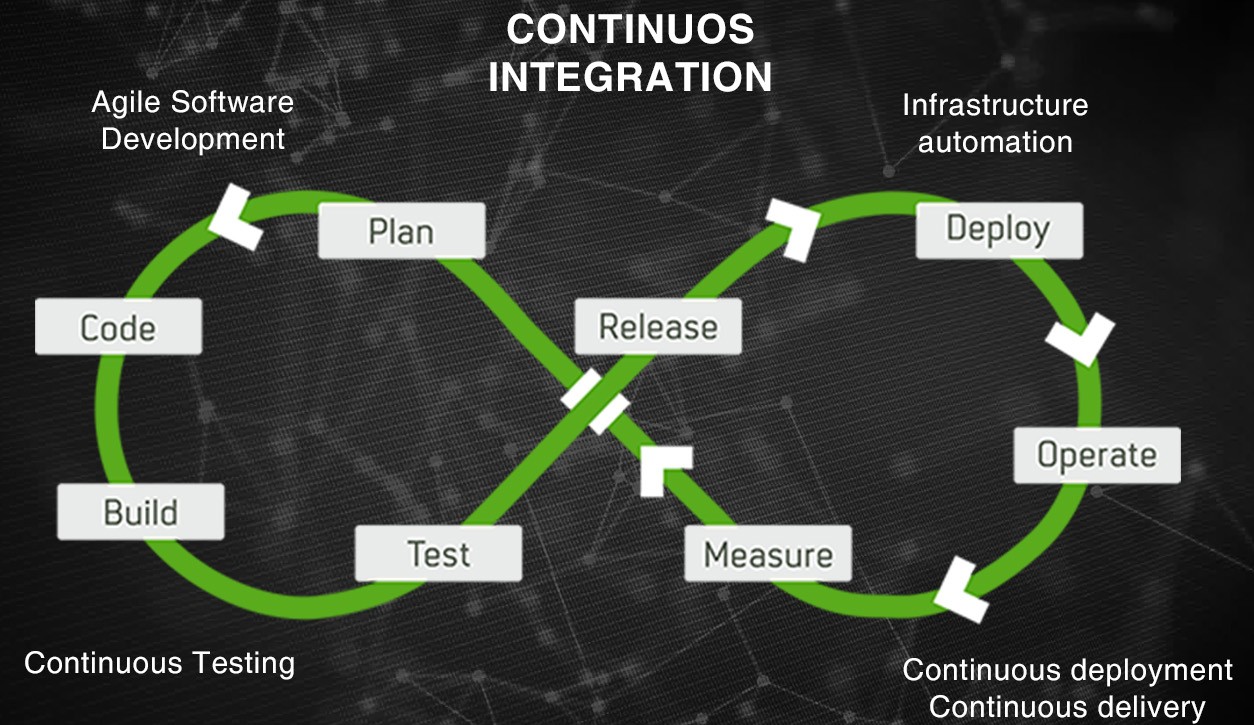

Read MoreContinuous integration (CI) and continuous deployment (CD) are powerful strategies that your software team needs to adopt, if it hasn’t currently already. How would you like a simple, low-cost path...

Read MoreIn case you haven’t been paying attention the past few years, Big Data has become a Big Deal. Of all the software development jobs in Houston, Texas right now, 25% revolves...

Read More